The Financial Reporting Council (FRC) has issued significant amendments to FRS 102, aligning lease accounting more closely with IFRS 16. These changes will affect most UK entities applying FRS 102 and will be effective for accounting periods beginning on or after 1 January 2026. Early adoption is permitted, provided all amendments are applied simultaneously.

This memo outlines the key changes, practical implications, and examples to help you prepare.

Key Change: On-Balance Sheet Lease Accounting:

The distinction between operating and finance leases is removed. Lessees must now recognise a right of use (ROU) asset and a lease liability for most leases.

Exemptions do apply for short-term leases (≤12 months) and some low-value assets (e.g. laptops and office furniture).

Applying the New Rules: Initial measurement and recognition

The initial lease liability is the present value of future lease payments discounted by the lessee’s ‘incremental borrowing rate’ – which is the rate of interest a lessee would pay to borrow the funds necessary to purchase the asset.

There is no need to restate comparative figures. Instead, entities should adjust their opening reserves at the transition date.

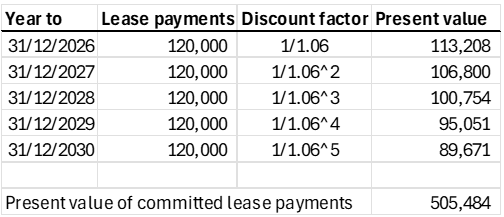

For an entity with a 31st December year-end and a commitment at 1st of January 2026 to pay a further 5 years rent at £10,000/month, the lease liability could be calculated as follows (assuming an IBR of 6%):

Therefore, the company’s fixed assets (property, plant and equipment) would increase by £505,484 as at 1st January 2026, and so too would its liabilities.

This will have a significant impact on the company balance sheet, with the increased liabilities negatively impacting the Net Current Assets which is seen as a key measure of financial health.

Applying the New Rules: Subsequent measurement

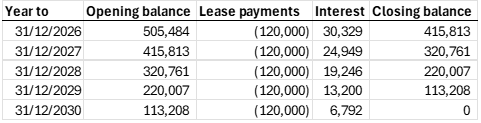

The right-of-use asset is then depreciated over the remainder of the lease term. In our example this would be (£505,484 / 5) = £101,097 per year.

The lease liability is reduced by the amount of payments made and increased by the interest charge as follows:

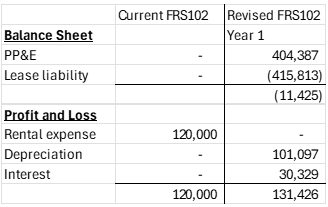

As a result, the profit and loss and balance sheet will look significantly different under revised FRS102:

Other considerations

Impact on valuations – EBITDA by its strict definition will improve as the cost of leasing is now shown under depreciation/interest which is added back.

- Impact on size thresholds – increased total assets and liabilities could affect classification as small/medium/large entity, which may trigger additional audit or reporting requirements

- Impact on banking covenants – Debt to equity ratios and EBITDA calculations will be impacted by the changes and impact on covenants.

Treatment of Right-Of-Use assets will need to be carefully tracked for tax purposes. If the asset recognition includes capital components (such as LBTT) then the full depreciation charge is not deductible for tax purposes.

So what are the next steps?

- Identify all lease arrangements

- Assess the impact on financial statements and discuss with lenders to avoid covenant breaches.

- Update accounting systems and policies

If you have any questions or would like help assessing the impact on your business, please get in touch.